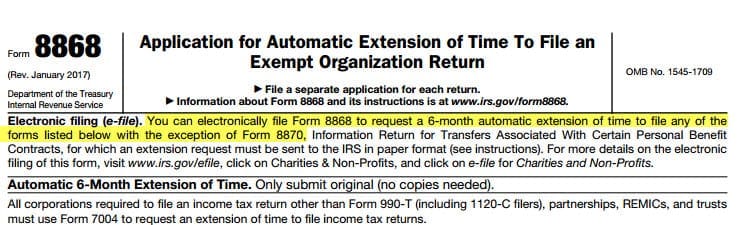

The interest and penalties will seem like nothing compared to the late filing penalties. The final point I'd like to emphasize is that you should always file your return on time, or request an extension, even if you don't have the money to pay. To be perfectly clear, a tax extension gives you more time to file your return, but not to pay your taxes. extension for your 2016 return if you file Form 4868 by April 18, 2017. Download your copy, save it to the cloud, print. Send the extension request on Form 4868 to the Internal Revenue Service office. Finish filling out the form with the Done button. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it. In the previous example of a $1,000 balance that's a year late, you would owe $30 in interest and $60 in penalties, unless you get it waived. Insert the current Date with the corresponding icon.

Unlike interest, the late payment penalty can be waived if you can show good cause for not paying on time. The late payment penalty is assessed in addition to interest and is 0.5% of any unpaid tax for each month or partial month it remains unpaid, up to a maximum of 25%. So, if you owe $1,000 and pay a year after the deadline, you'll owe $30 in interest. You may be able to apply for an extension if youre not ready to file your. The IRS's interest rate can vary, and is 3% for underpayments as of the first quarter of 2016. Total amount paid with request for extension of time to file, tax paid with. Learn about extensions for filing & paying Massachusetts income tax. You will owe interest on any tax not paid by the normal due date, even if you have a legitimate reason for not paying on time - such as being out of the country or some other hardship.

0 kommentar(er)

0 kommentar(er)